The "One Big Beautiful Bill" (OBBB), signed into law on July 4, 2025, brings significant changes to employee benefits and compliance. We understand that reviewing all the information and determining its impact on your benefits program can be tedious.

We’ve summarized the key details you should know about what's expected to change with employee benefits now that the OBBB has passed.

"One Big Beautiful Bill": Key Employee Benefit Changes You Should Know

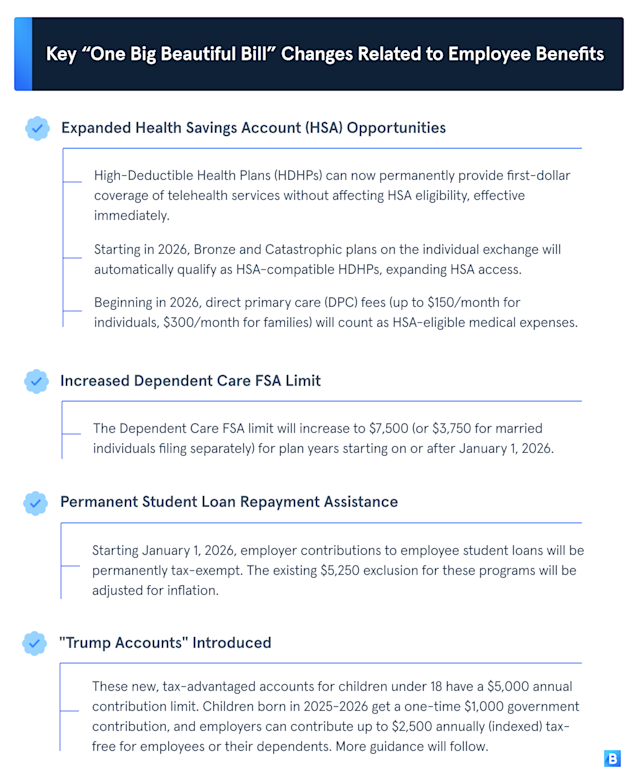

Expanded Health Savings Account (HSA) Opportunities

High-Deductible Health Plans (HDHPs) can now permanently provide first-dollar coverage of telehealth services without affecting HSA eligibility, effective immediately.

Starting in 2026, Bronze and Catastrophic plans on the individual exchange will automatically qualify as HSA-compatible HDHPs, expanding HSA access.

Beginning in 2026, direct primary care (DPC) fees (up to $150/month for individuals, $300/month for families) will count as HSA-eligible medical expenses.

Increased Dependent Care FSA Limit

The Dependent Care FSA limit will increase to $7,500 (or $3,750 for married individuals filing separately) for plan years starting on or after January 1, 2026.

Permanent Student Loan Repayment Assistance

Starting January 1, 2026, employer contributions to employee student loans will be permanently tax-exempt. The existing $5,250 exclusion for these programs will be adjusted for inflation.

"Trump Accounts" Introduced

These new, tax-advantaged accounts for children under 18 have a $5,000 annual contribution limit. Children born in 2025-2026 get a one-time $1,000 government contribution, and employers can contribute up to $2,500 annually (indexed) tax-free for employees or their dependents. More guidance will follow.

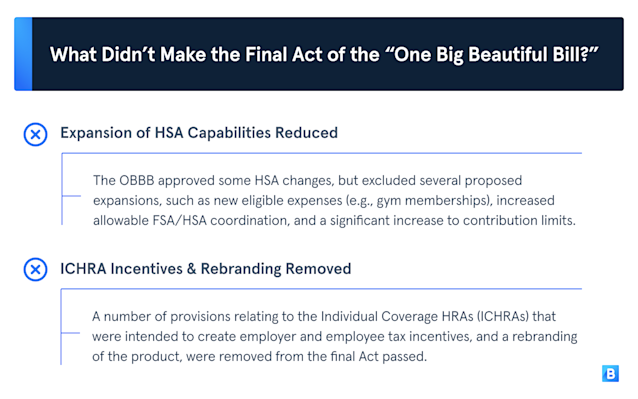

What Didn’t Make the Final Act of the “One Big Beautiful Bill?”

Expansion of HSA Capabilities Reduced

The OBBB approved some HSA changes, but excluded several proposed expansions, such as new eligible expenses (e.g., gym memberships), increased allowable FSA/HSA coordination, and a significant increase to contribution limits.

ICHRA Incentives & Rebranding Removed

A number of provisions relating to the Individual Coverage HRAs (ICHRAs) that were intended to create employer and employee tax incentives, and a rebranding of the product, were removed from the final Act passed.