In-Network vs. Out-of-Network: What's the Difference and Why Does it Matter?

Have you ever gotten an unexpected bill because the doctor you received health services from turned out to be an out-of-network provider? It is important to understand the differences between out-of-network vs in-network physicians to ensure you know how much you will pay out of pocket to receive care.

Read more to find out the key tips and tricks you need to know to avoid unexpected bills from out-of-network providers.

Key Takeaways

Going to an in-network provider will result in lower out-of-pocket costs and help you avoid unexpected bills

Out-of-network providers may request payment for fees higher than the health insurance carrier will pay, resulting in you having to pay the balance. This practice is also referred to as balance billing

Always check your insurance carrier provider lookup tools to confirm if the doctor you are seeing is in or out-of-network

In-Network vs. Out-of-Network Providers

A group of doctors and healthcare providers contracted directly with your health insurance carrier is considered an in-network provider. The health insurance company negotiates contracts directly with in-network providers to help control health care costs and quality of care for their members.

An out-of-network provider is a doctor or health care provider that does not have a contract set up with your health insurance carrier. These providers are not limited to specific fees to charge the member for health care services received. This can expose members to unexpected bills and higher than anticipated service fees.

What Happens if I Go to an Out-of-Network Provider?

If you accidentally (or purposefully) go to an out-of-network provider, you will likely pay higher costs than if you went to an in-network provider. This is due to the following key reasons:

Out-of-network plan design provisions are more costly than if you stay in-network. Your health plan typically has different plan coverage levels for in-network versus out-of-network services. In most cases, your plan will charge you higher costs if you go out of network.

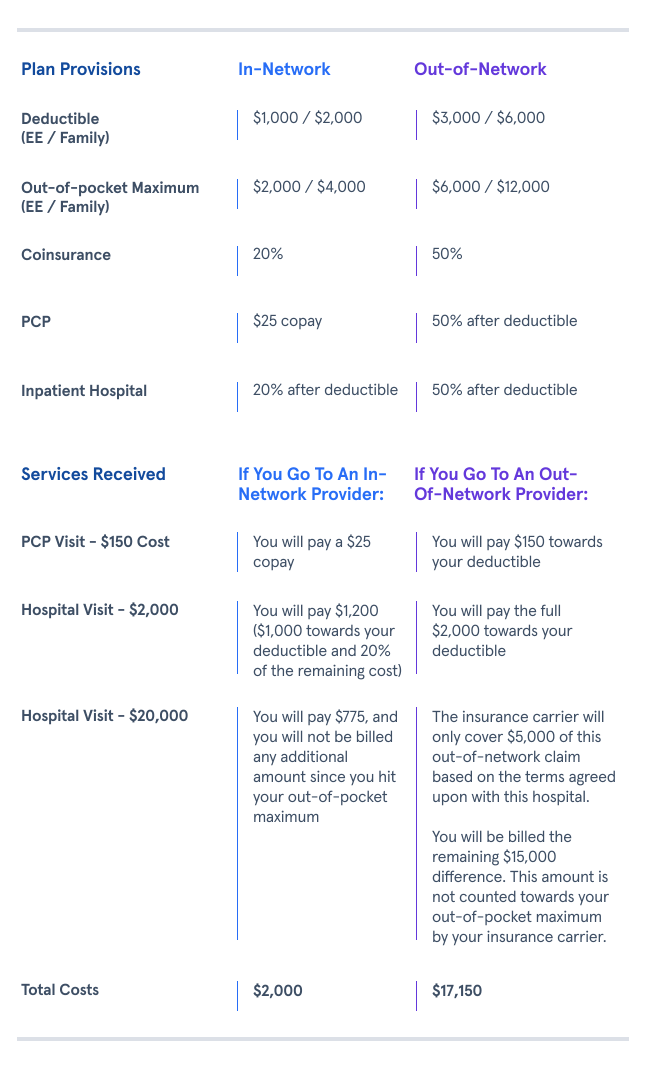

For example, under a PPO plan design, you may have a $25 copay for an in-network primary care physician visit. Under that same plan design, if you saw an out-of-network primary care physician, you may be required to pay a 50% coinsurance (50% of the total cost of the visit) after you hit your deductible.

You may be subject to balance billing by an out-of-network provider. If you go to an out-of-network doctor and they charge you a higher amount than what your insurance carrier will pay, your doctor may bill you (the member) the difference in cost. Sometimes this additional amount will not apply towards your out-of-pocket maximum, resulting in you being subject to much higher costs than expected.

Your plan may not cover out-of-network costs. If you are enrolled in an HMO or EPO plan design, out-of-network services are not covered by your health insurer. This means you would be subject to the full undiscounted cost of services.

Below is an example of common cost differences between an in-network and out-of-network provider. Under this example, you are enrolled in the below PPO plan design:

Notice how the deductible, out-of-pocket maximum, and coinsurance increase when you go to an out-of-network provider? It’s worth it to confirm with your provider (before receiving any services) to make sure that they are in your network, as it will make a big difference in costs.

Considering that you already pay a premium and are responsible for a deductible, copay, and coinsurance, you want to make the most out of your plan and avoid unnecessary extra expenses.

How to Check In-Network vs. Out-of-Network Status

All insurance carriers have provider lookup tools within their websites that allow you to research if your doctor or specialist is in or out-of-network. Please be sure to check your insurance carrier website or call their customer service line directly if you are unsure if your provider will be considered in or out-of-network.

Bottom Line

Staying in-network whenever possible will almost always result in lower out-of-pocket costs than if you see an out-of-network provider.

Now that you have a better understanding of how insurance plans work, we hope this will empower you to use your benefits to their full potential (and avoid spending more than you need to).