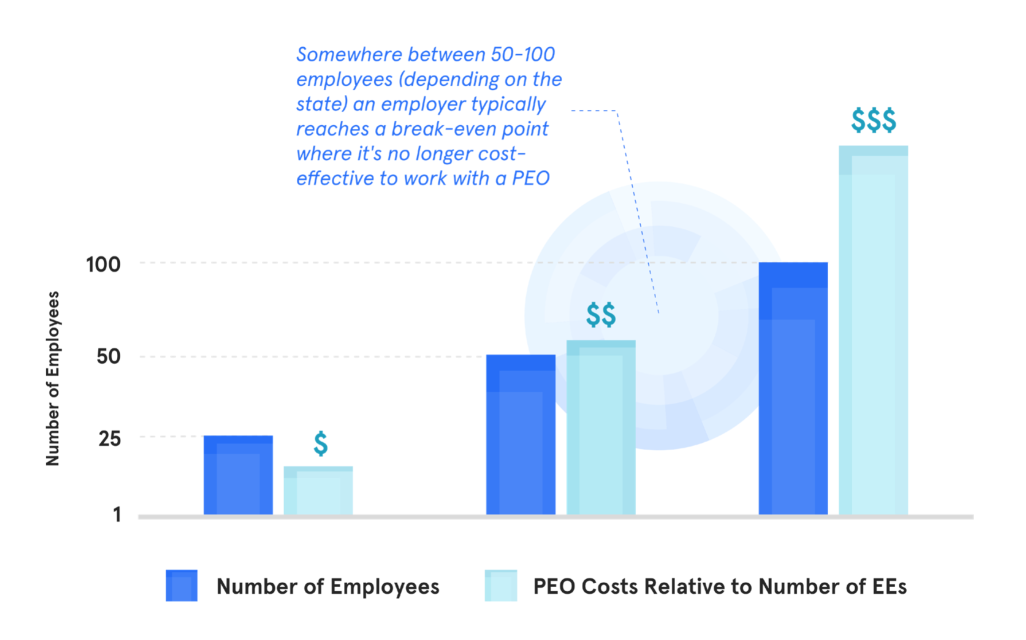

If you’re on a PEO and have reached the point where the administrative fees outweigh the insurance cost savings, then it may be time to step out from under the PEO’s umbrella and set up your own set of HR systems, benefits, and processes.

Here are five key things to consider when exiting from your PEO and setting up your own program internally:

Benefits

HR Systems

Employment Liability & HR Compliance

Staffing

Timing

1. Consider Your Benefit Options & Employee Communications

Health benefits, worker’s compensation insurance, 401(k), and other perks came out-of-the-box and ready to go with your PEO. If you recall, when your company joined the PEO, you were presented with a menu & just needed to make your selections.

Looking outside the PEO, you’ll need to identify the carriers, administrators, and plans that meet your employees’ needs, and create new ways to communicate these benefit changes to your employees. Working with an experienced broker or consultant can help you get this all in place.

2. Find the Right HR System

Just as with benefits, the HRIS, ben admin, and payroll software likely came out-of-the-box with the PEO as well. You’ll need to identify the right platform that will be able to perform these functions for your company.

You’ll also have to decide whether to bundle with an all-in-one system, or you can separate them, working with one vendor for HRIS, another for ben admin, and yet another for payroll if you choose (not to mention the additional types of vendors you can add for timekeeping, scheduling, applicant tracking, and learning management, just to name a few).

3. Consider Employment Liability & HR Compliance Support

In all likelihood, your PEO took on various forms of liability for your company, like employment liability and tax remittance. These are items for which you’ll now be responsible, and it is important to review them with legal counsel to ensure that you have the resources and processes in place to remain compliant with federal and state laws.

4. Will You Need Additional Staffing?

Depending on your PEO, you may be accustomed to a certain level of administrative support. For example, some PEOs allow you to be completely hands-off, while others provide you with tools & resources, but you still have to “push the button” to run payroll or approve changes submitted by your employees.

When moving off a PEO, it is important to consider whether you may need to hire an additional employee or bring in some additional contract HR support to help with the administrative tasks the PEO handled previously but that are now your responsibility.

5. Exiting at the Right Time

One of the most important but often overlooked factors is timing. Whenever an employer moves off a PEO or changes payroll vendors mid-year, the payroll taxes already paid in that year may restart.

This means that as an employer, you may be on the hook to pay more tax than you would have if you remained on the PEO through the end of the year. Therefore, most companies moving off a PEO aim to align this with January 1, since it coincides with the tax year and calendar year start as well.

Work with Experienced Benefits Consultants

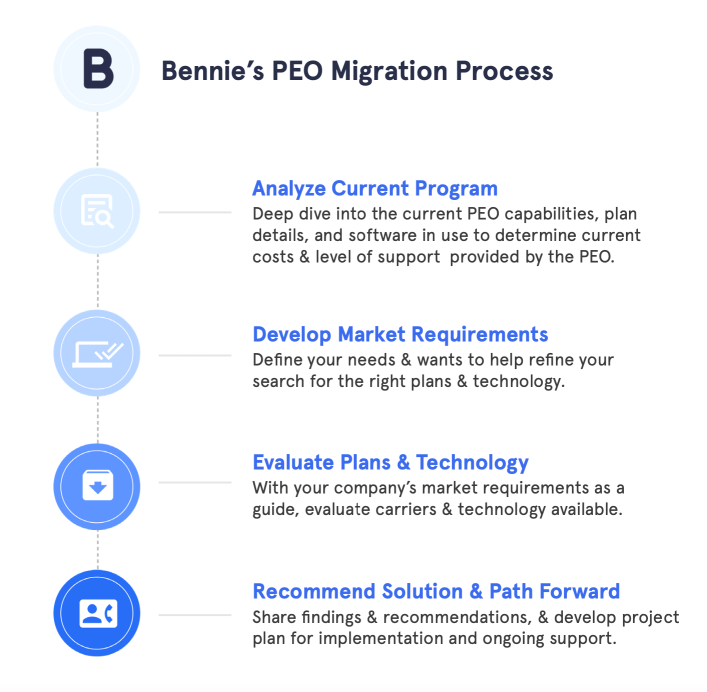

As mentioned above, it’s critical that you work with an experienced consultant and broker who can help you identify the right combination of vendors, resources, and technology that will facilitate a smooth transition off your PEO. Not all brokers are equal, and quality of service is a crucial detail to consider when looking for the right brokerage.

Bennie is a full-service employee benefits broker, licensed in all 50 states, and maintains national relationships with all major insurance carriers. When working with Bennie, you get a holistic, 360 view of your benefits with strategic, quarterly touchpoints. From establishing the right goals to implementing strategy and reviewing renewals, Bennie works as an extension of your team to simplify benefits for you and your employees.

The Bennie team is ready and able to help you think through all of the above and can help you build the right HR, payroll, and benefits program for your company. Contact us today or schedule a demo to learn more about how Bennie can take your employee benefits to the next level.