There’s a lot to know when it comes to insurance, and it can feel overwhelming trying to keep track of it all. While you’re hunting for health coverage, a whole host of other questions may spring up, including, “Is vision insurance required?” The short answer is no, not for adults, but let’s take a deeper look at that!

While the Affordable Care Act used to require people to carry health insurance, as of 2024, individuals in most states are no longer penalized for being uninsured. That includes vision insurance.

However, California, Massachusetts, New Jersey, Rhode Island, Vermont, and Washington, D.C. still require health insurance coverage. There could be penalties if you are uninsured and living in one of those states.

Optometry vs. Ophthalmology: What Is Covered by Vision Insurance?

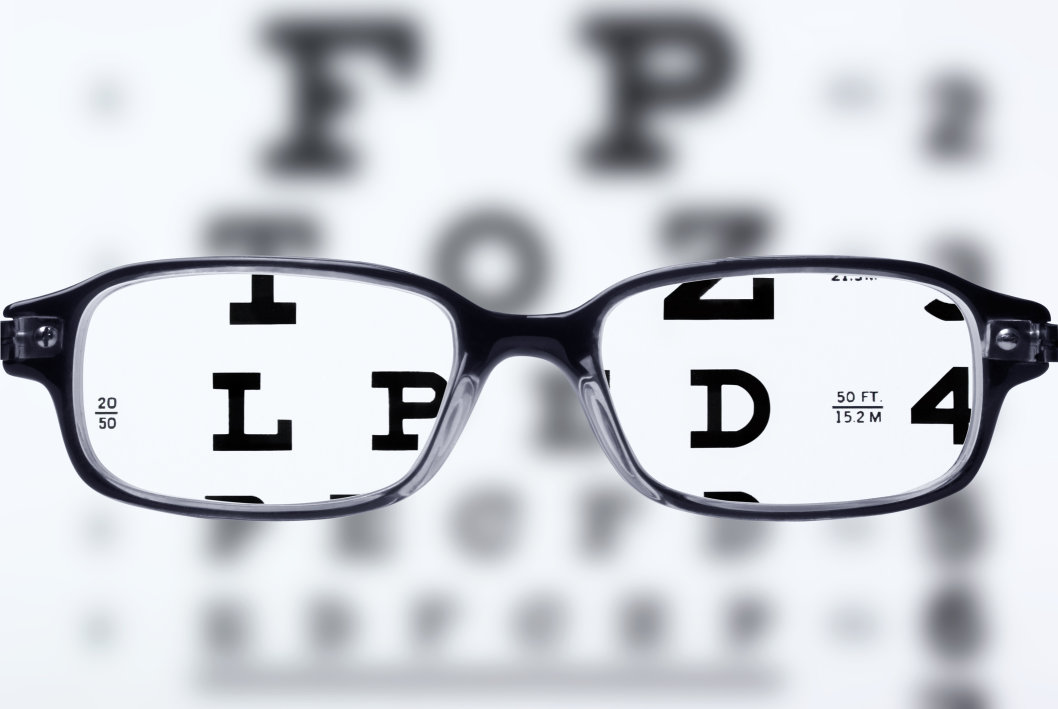

When we talk about vision insurance, we typically mean coverage for services provided by optometrists: preventative care, like eye exams and corrective eyewear.

Many vision plans also offer discounts on services like Lasik - that’s corrective eye surgery - on top of that. If you are seeking medical treatment for an eye injury or other service provided by an ophthalmologist, that care would likely be covered by health insurance instead, as these are medical issues.

So, in short, vision insurance covers exams and eyewear, while eye injuries and other medical issues would fall under health insurance. Be sure to check your plan details to know what’s covered.

Is Vision Insurance Required for Adults?

It is not. Lack of health insurance (including vision) is no longer penalized by the federal government. State-to-state, there may be insurance mandates, but regardless of where you live, vision coverage is not required by the ACA. That said, many health plans will still include vision insurance. Check the details of your plan to see if vision services are covered.

Is Vision Insurance Required for Children?

Outside of a few states, insurance coverage is no longer mandated for anyone. However, pediatric vision care is considered an essential health benefit for children. The Affordable Care Act ensures that vision coverage be included in health insurance plans for children under 19. What that means is, all small group and individual plans will cover eye exams, vision screening, and corrective lenses for kids.

What Does Vision Insurance Cost?

Vision insurance is relatively inexpensive, but the exact cost will vary depending on your needs. Most plans have a monthly premium that ranges between $5 and $15 per person, which comes out to between $60 and $180 annually.

On top of that, of course, there may be copayments, which are small fees paid at the time of visit for certain services, or a deductible, which is a total cost amount that you must reach before insurance kicks in.

Do I Need Vision Insurance?

Do you need corrective lenses? Do you have a family history of eye disease or a condition like diabetes that can increase the risk of eye disease? Are you over age 55? If any of these apply to you, vision insurance may be worth purchasing. Vision coverage will go a long way toward making your glasses or contacts much more affordable.

On the other hand, if you are only going for routine exams (which, based on your age, may not even be needed annually) and don’t need corrective lenses or other treatments, you may find that opting into something cheaper, like a discount plan, or even just paying out of pocket, will save you money in the long run.

Getting Coverage

All health insurance plans will include vision coverage for children, but only some will include the same coverage for adults. Be sure to review your plan details carefully to see what is available. If adult vision coverage isn’t included, there may still be a stand-alone option available that works well for you!

While the federal Marketplace doesn’t currently offer stand-alone vision plans, some state-level insurance marketplaces do. So, a great place to start is your state’s Department of Insurance website. You may also have luck working with an insurance agent or shopping directly from insurance providers online.

If you’re unable to track down a vision insurance plan that works for you, there are still other options to help lower the cost of your trips to the optometrist! You may want to consider a discount plan. Discount or savings plans are not insurance, but they do provide discounts and flat rates on procedures and eyewear for a low monthly fee.

Wrapping Up: Do You Need Eye Insurance?

Is vision insurance required? No, but if you need glasses or other eye care services, it could save you a lot of money in the long run! You’ve taken your first steps to educating yourself on the cost of vision insurance. Next, you’ll want to consider whether purchasing a plan could save you from having to pay a much larger fee for a service later.